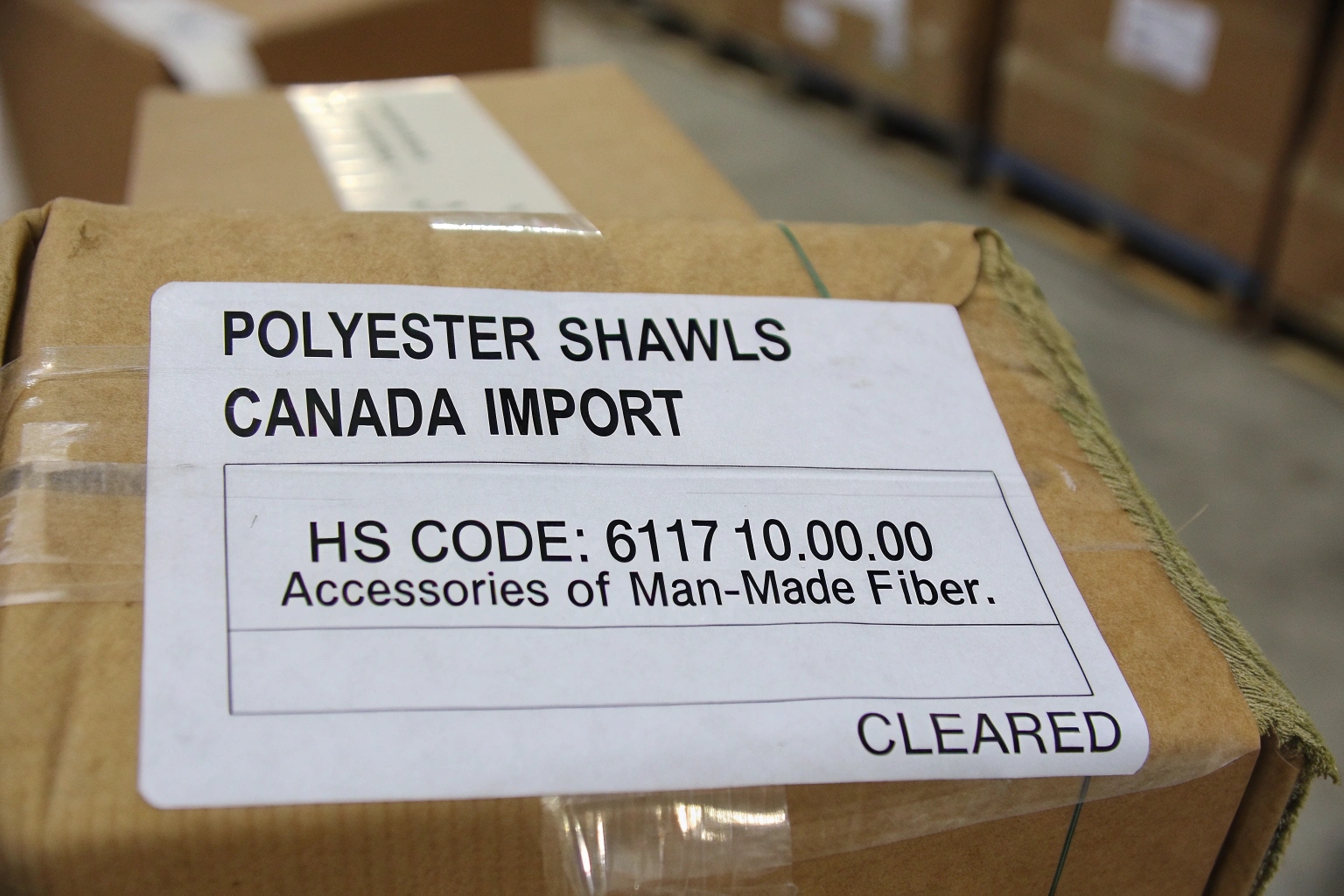

What’s the HS Code for Polyester Shawls Shipped to Canada?Shipping shawls to Canada? If you get the HS code wrong, you may face delays or overpay duties.

The correct HS code for polyester shawls exported to Canada is typically 6117.10.00.00, which covers accessories like shawls, scarves, and veils made from man-made fibers.

At AceAccessory, we’ve helped Canadian importers clear customs quickly by providing precise classification for each type of accessory. In this article, I’ll explain how HS codes work for shawls, how to verify them for Canada, and what to include in your documents to avoid extra fees.

What is the HS code for polyester shawl?

Every item shipped internationally must be labeled with a Harmonized System (HS) code—a global standard for customs classification.

For polyester shawls, the standard HS code is 6117.10.00.00, covering “accessories made of knitted or crocheted man-made fibers,” which applies to most modern shawls.

Why 6117.10 for polyester shawls?

Shawls are considered accessory garments, not outerwear. The HS code 6117.10.00.00 covers:

- Shawls

- Scarves

- Mufflers

- Mantillas

- Veils

…made from man-made knitted or crocheted fabrics—such as polyester, acrylic, or nylon.

| Material | Knitted? | HS Code | Description |

|---|---|---|---|

| Polyester | Yes | 6117.10.00.00 | Accessories, man-made fiber, knitted |

| Silk | No | 6214.10.00.00 | Accessories, silk or silk waste |

| Cotton | Yes | 6117.10.00.00 | Treated as knit accessory in some cases |

| Wool Blend | Yes | 6117.10.00.00 | Same if synthetic content dominates |

If the shawl is woven instead of knitted, the code may shift to 6214.30.00.00 (accessories of synthetic woven fabric). We classify this at production stage by fabric spec, so there are no surprises later.

What is the HS code for clothing to Canada?

If you ship other fashion items alongside shawls, you’ll need to classify each correctly.

Clothing HS codes to Canada vary by garment type, material, and gender category. Shawls fall under accessories, while sweaters, shirts, and trousers have separate chapters.

How are HS codes structured in Canada for apparel?

Canada uses the Harmonized System (6-digit) with a Canadian Customs Tariff (10-digit) extension. Here’s how apparel codes are structured:

| Category | HS Chapter | Common Codes (Examples) |

|---|---|---|

| Shawls & Scarves | 61 or 62 | 6117.10.00.00 / 6214.30.00.00 |

| T-shirts | 61 | 6109.10.00.00 |

| Sweaters | 61 | 6110.30.00.00 (acrylic) |

| Trousers (Women) | 62 | 6204.63.00.00 (polyester) |

| Gloves | 61 | 6116.93.00.00 |

| Hats | 65 | 6505.00.90.00 |

Canadian customs focuses heavily on fiber content and knit vs. woven distinctions. We help you match labels to codes and avoid misclassification.

For all our Canada-bound shawls, we use fiber test reports from production and declare the fabric content by percentage (e.g., 100% polyester).

What is the HS code for shawls?

Shawls can fall under multiple codes—depending on material and how they're made.

The HS code for shawls is 6117.10.00.00 if knitted from synthetic fibers, and 6214.30.00.00 if woven from synthetic fibers. Natural fibers follow separate codes.

Knit vs. Woven: How to tell the difference for classification?

At AceAccessory, we classify every batch of shawls based on:

- Yarn type (polyester, acrylic, cotton, etc.)

- Construction method (knit, woven, crochet)

- Finish style (brushed, printed, jacquard)

Here’s a simple matrix:

| Fabric Type | Construction | HS Code | Notes |

|---|---|---|---|

| Polyester | Knitted | 6117.10.00.00 | Most common for casual shawls |

| Polyester | Woven | 6214.30.00.00 | Often for formal styles |

| Acrylic Blend | Knitted | 6117.10.00.00 | Soft winter scarves or shawls |

| Wool | Woven | 6214.20.00.00 | Higher duties and EU-specific docs |

Some customs officers may request a fabric swatch or fiber declaration. We include both in every shipment, so your Canadian broker has everything on hand.

What is HS Code 611710?

This is the most common code we use for polyester shawls.

HS Code 6117.10.00.00 refers to "Accessories: shawls, scarves, mufflers, mantillas, veils, knitted or crocheted," made from synthetic fibers like polyester.

Why is 611710 so important for apparel accessories?

It’s used worldwide. Most U.S., Canadian, and EU customs systems mirror this classification for:

- Knitted shawls

- Synthetic scarves

- Stretchy mufflers

Here’s what you should know:

| Code | Description | Duty Rate (Canada) |

|---|---|---|

| 6117.10.00.00 | Synthetic knitted shawls or scarves | ~16–18% |

| 6214.30.00.00 | Synthetic woven shawls or scarves | ~17–20% |

| 6214.10.00.00 | Silk woven shawls | Varies |

Note: Duty rates may change based on trade agreements (e.g., CPTPP, USMCA). We provide certificates of origin (Form B232) for Canada shipments that may qualify for preferential tariffs.

We also help our clients reduce declared value legally by excluding certain packaging or non-dutiable items from the invoice total.

Conclusion

If you're shipping polyester shawls to Canada, you’ll most likely need HS code 6117.10.00.00. It’s the international standard for knitted accessories made of synthetic fibers. At AceAccessory, we handle all classification, labeling, and shipping documentation—so your shawls reach customs fast and fee-free.