If you're importing accessories like belts, gloves, or certain metal components from China, you’ve probably heard of anti-dumping duties (ADD). These duties can unexpectedly raise costs, delay deliveries, or even block goods at customs—if you're not prepared.

To navigate anti-dumping duties on Chinese accessories, you need accurate HS code classification, a deep understanding of product scope, and the right sourcing or shipping strategy to mitigate risk.

I’ve seen importers get blindsided by 200% duties simply because their product was “similar enough” to a penalized one. But with planning, documentation, and a smart factory partner, it’s manageable—and even avoidable.

What types of accessories are most impacted by ADD?

Some accessories fall into categories where U.S. or EU regulators believe Chinese exporters are “dumping”—selling below cost to hurt local industries. When that happens, ADD gets triggered.

Commonly affected accessories include leather belts, synthetic gloves, certain metal buttons or fasteners, and coated textiles. The classification and material makeup are key.

Which countries have active ADD policies on Chinese goods?

- United States: Belts, aluminum buckles, textile gloves

- European Union: Certain metal fittings, safety accessories

- India: Synthetic leather accessories, caps

- Brazil: Textile-based fasteners and garment closures

What triggers an anti-dumping investigation?

- Sudden surges in import volume from China

- Domestic manufacturers filing complaints

- Investigations into price undercutting

- Importer misclassification or abuse of HTS codes

How can you correctly classify accessories to avoid ADD?

Incorrect HS codes are one of the fastest ways to trigger ADD. Some importers try to save duty by reclassifying, but customs systems are smarter than that now.

Using accurate and documented classification is your first line of defense. Partner with a supplier like AceAccessory that helps ensure the code matches the material and function.

What tools can help?

- Customs Rulings Online Search System (CROSS) in the U.S.

- Binding Tariff Information (BTI) in the EU

- Trade advisors or customs brokers

- Pre-shipment customs audits from factories

What information must you retain?

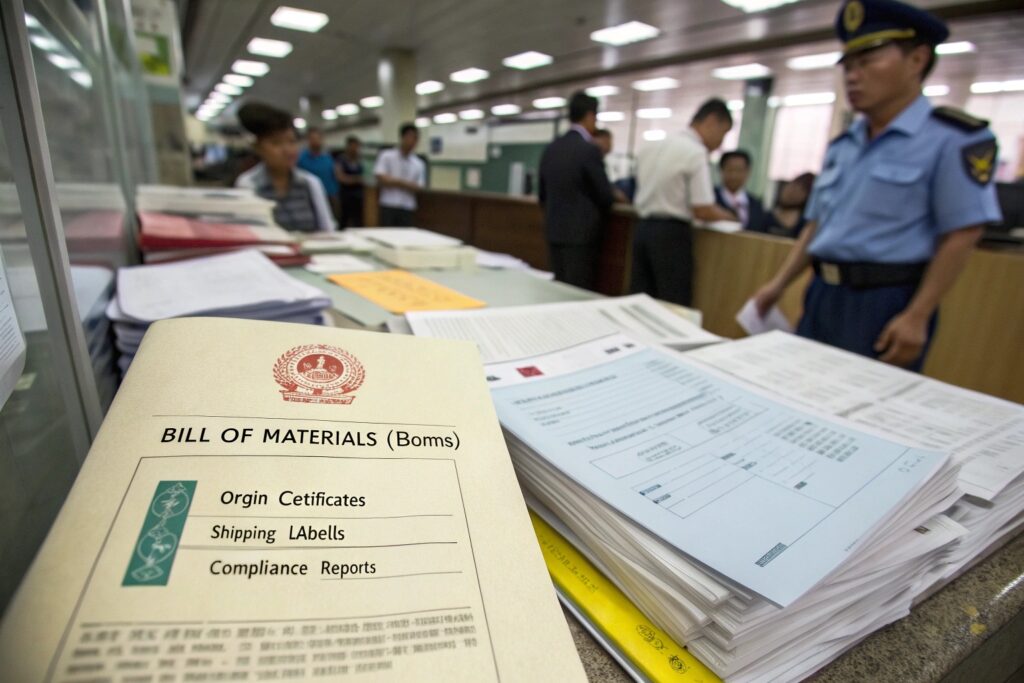

| Document Type | Purpose |

|---|---|

| Bill of Materials (BOM) | Material breakdown |

| Product Photos | Visual proof for classification |

| Samples or Swatches | For customs testing |

| Certificate of Origin | May influence MFN rates |

We provide full documentation per shipment. Our belts, for instance, include buckle alloy composition and leather origin to help importers defend their classification.

Can you mitigate ADD through alternate shipping or sourcing?

Sometimes, the best way to manage anti-dumping duties is to avoid triggering them at all.

Through transshipment, alternate production, or using bonded zones, some accessories can be sourced without breaching ADD scope. It all depends on the product structure and compliance.

What are some legal risk-avoidance options?

- Transshipment via Southeast Asia

- Requires real manufacturing process (not just relabeling)

- Bonded Zone Processing

- Only feasible for large volumes and advanced planning

- Partial Material Sourcing from Other Countries

- Breaks direct China origin in some cases

- Shift to Tariff-Free Products

- E.g., switching from plated metal to plastic-based accessories

Our factory supports clients who want to shift part of the processing (like embroidery or finishing) to other regions through our partner network.

What documentation protects you during customs inspection?

When customs flags a shipment for potential ADD, it's up to the importer to prove it’s out-of-scope or correctly declared. If your factory hasn’t prepared this in advance, you’re exposed.

With AceAccessory, we prepare supporting documents upfront for each product, including detailed material info, compliance test reports, and labeling aligned with customs expectations.

What are the most requested documents in ADD-related holds?

| Document | Reason for Request |

|---|---|

| Packing List with Descriptions | Confirms accessory type |

| Product Construction Diagram | Validates product function |

| Manufacturer’s Statement | Source and intent clarification |

| Shipment Photos | Avoids substitution suspicion |

| Material Composition Certificates | Confirms scope vs. exemption |

Proactively providing these helps clear shipments faster and avoid retroactive ADD billing—sometimes applied months after delivery.

Conclusion

Anti-dumping duties can feel like a moving target, but with the right strategy, they don’t have to block your business. Classify accessories correctly, prepare full documentation, and partner with a transparent, experienced factory like AceAccessory.

We’ve helped clients avoid unnecessary ADD risks through clean sourcing, real-time compliance support, and flexible production strategies. Let us support your next shipment—and keep your accessories profitable and penalty-free.