When importing accessories and fashion products into the United States or Europe, tariff classification disputes can quickly become a costly headache. Many buyers and importers face unexpected duties, delays, and compliance risks when customs authorities challenge the classification of their goods. If the classification is wrong, the tariff rate can rise significantly, affecting profit margins and delivery timelines. This is one of the most common pain points for importers working with Chinese manufacturers like us.

The best way to handle tariff classification disputes with customs authorities is to prepare strong documentation, maintain transparent communication, and seek professional support when necessary. By understanding the classification system, using advance rulings, and working closely with reliable suppliers, importers can avoid costly misclassifications and resolve disputes more efficiently.

As a professional fashion accessories manufacturer and exporter in China, I have seen many of my customers experience such challenges. But with the right approach, they not only reduce risks but also build a more secure and predictable supply chain. In this article, I will share practical strategies that can help you handle tariff classification disputes smoothly and confidently.

Why Do Tariff Classification Disputes Happen?

Importers often feel frustrated when their goods are suddenly reclassified by customs, leading to unexpected costs. The problem usually comes from vague product descriptions, inconsistent coding, or changing regulations. Without clarity, customs authorities may apply a higher duty rate.

Tariff classification disputes usually happen because of unclear product descriptions, insufficient documentation, or differences in interpretation between importers and customs authorities.

When I first started exporting to North America, one of my clients faced a sudden reclassification on a batch of scarves. Customs argued that the material description was incomplete. After weeks of back-and-forth, we solved the problem by preparing detailed product specifications and providing lab test reports.

What role does product description play in disputes?

A simple product name like “belt” can mean many things to customs. If you don’t specify whether it is a leather belt, a fabric belt, or even a decorative sash, customs may choose a category with a higher tariff. A detailed description, including material composition and intended use, often prevents disputes.

Can changing regulations trigger disputes?

Yes. International tariff rules are updated regularly. For example, under the Harmonized Tariff Schedule (HTS), even minor updates can shift a product’s classification. Importers who don’t track these changes may suddenly face disputes during customs clearance.

How to Prevent Tariff Classification Problems Before Shipping?

Every importer wants smooth customs clearance, but prevention is better than dealing with disputes later. Proactive steps before shipping can save weeks of delays and unexpected costs.

The most effective way to prevent classification problems is to provide complete documentation, use advance rulings when available, and work with experienced suppliers who understand tariff codes.

I always advise my clients to invest time in pre-shipment preparation. When we prepare HS codes, product samples, and certifications in advance, the chances of dispute drop dramatically.

Should importers apply for advance rulings?

Yes. Many customs authorities, such as U.S. Customs and Border Protection (CBP), allow importers to request advance rulings on product classification. This official decision is binding and provides legal certainty, protecting you from future disputes.

How important is supplier experience in documentation?

Very important. A supplier with a strong quality control process can prepare accurate product descriptions, testing certificates, and packaging labels. In my experience, this often reassures customs authorities and reduces clearance risks.

What Steps to Take During a Customs Dispute?

Even with preparation, disputes can still happen. The key is to stay calm, respond professionally, and provide strong evidence to support your case.

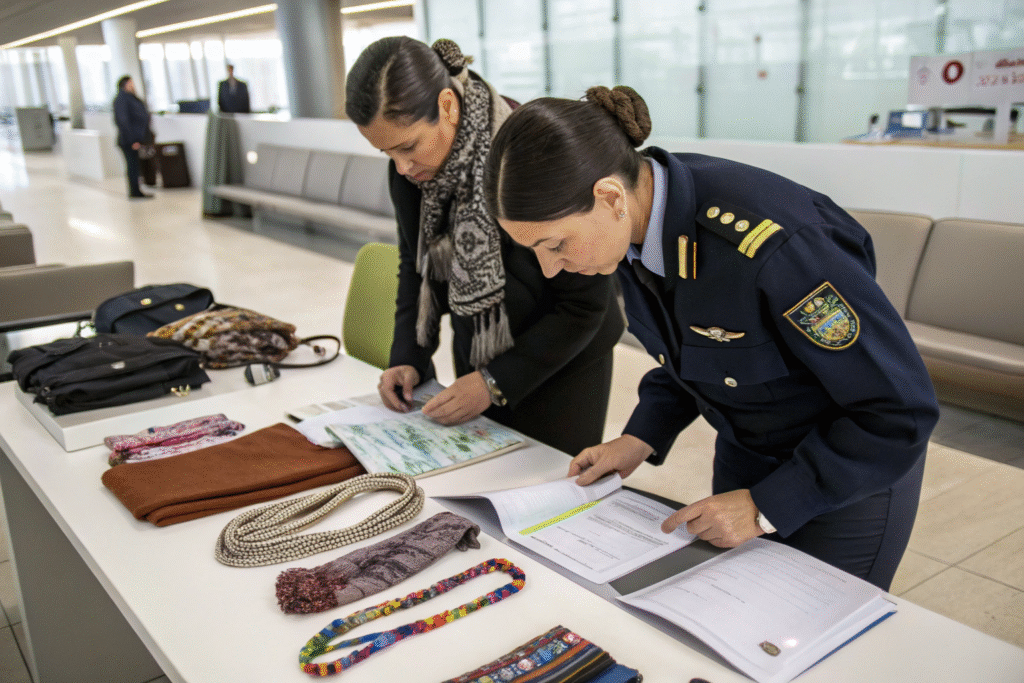

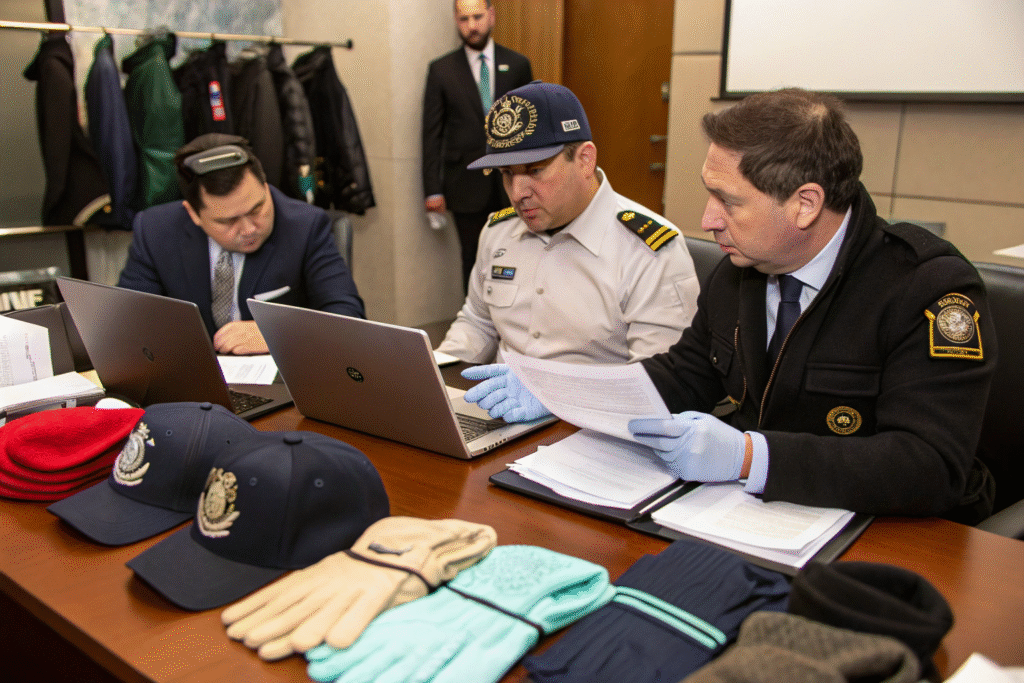

When facing a customs dispute, importers should request written explanations, submit technical documents, and, if necessary, involve trade professionals such as customs brokers or trade attorneys.

I remember a U.S. importer of ours had their hair clips reclassified as jewelry, which carried a higher duty rate. We worked with a customs broker to submit technical documents showing they were hair accessories, not jewelry. After a review, customs accepted our position.

Should importers work with customs brokers?

Yes. Professional customs brokers have experience dealing with disputes and know how to present the right evidence. They can also communicate with customs officers on your behalf, saving you stress and time.

Is it useful to escalate disputes legally?

Sometimes. If you believe customs made an error, you can appeal the decision. Many companies choose to file formal protests under 19 U.S.C. §1514. While this takes time, it may recover overpaid duties.

How Can Reliable Suppliers Help Importers Reduce Risks?

One of the most overlooked strategies is working with the right supplier. A reliable manufacturer can make the difference between smooth customs clearance and endless disputes.

Reliable suppliers reduce tariff risks by providing accurate HS codes, detailed documents, and professional support during customs inspections.

As a supplier, I take responsibility for providing complete classification support to my clients. From Zhejiang, China, we have helped many importers in the U.S. and Europe avoid disputes through careful documentation and proactive communication.

Can suppliers support classification research?

Yes. Experienced suppliers often monitor classification changes. For example, we regularly review updates from the World Customs Organization (WCO) to ensure our HS codes are accurate. This research helps clients reduce risks before products ship.

What role do suppliers play during disputes?

Suppliers can provide technical samples, testing reports, and product history that support an importer’s case. For example, we once helped a European buyer prove that their knit hats should not be classified as industrial protective gear, but as fashion accessories. The dispute was resolved quickly.

Conclusion

Tariff classification disputes are a reality for every importer in the fashion accessories industry. They can cause delays, higher costs, and frustration. But with preparation, transparency, and professional support, disputes can be minimized and resolved effectively. Importers should always provide detailed documentation, apply for advance rulings, work with customs brokers when needed, and rely on suppliers who understand classification rules.

At AceAccessory, we pride ourselves on supporting our clients through every step of the import process. If you are ready to source high-quality accessories and want a reliable partner who can help you reduce risks, contact our Business Director Elaine at elaine@fumaoclothing.com today. We are here to make your importing experience smoother, faster, and more secure.