You found a good supplier, placed the order, arranged shipping—then your gloves or hats got stuck at customs. Delays, fines, and surprise fees can derail your business if you don’t handle clearance right.

Customs clearance is critical when importing gloves and hats from China because it ensures your shipment meets local laws, passes border checks, and avoids delays or penalties. Proper classification, documentation, and duty payment are essential to keep your goods moving.

Let’s break down what customs clearance really involves, what taxes apply, and how to keep your imports smooth and compliant.

What is the custom duty for import from China?

Not budgeting for customs duties means surprise costs that eat your margin. Gloves and hats, especially made from leather, fabric, or knit, often have higher-than-expected tariffs.

Import duties from China vary based on product type and destination. For gloves and hats, duties can range from 5% to 20%, depending on material and country. Some nations apply anti-dumping duties or special taxes on textile accessories.

Sample duty rates by product (for USA imports)

| Product | HS Code Range | Estimated Duty Rate |

|---|---|---|

| Knitted gloves | 6116.10.xxxx | 10–13% |

| Leather gloves | 4203.21.xxxx | 7–12% |

| Fabric hats | 6505.00.xxxx | 8–15% |

| Straw or felt hats | 6504.00.xxxx | 12–20% |

Always verify the HS code (Harmonized System code) with your customs broker or forwarder, as incorrect classification can lead to fines or product seizure.

Do trade agreements lower duty rates?

Yes. Some countries have Free Trade Agreements (FTAs) or Most Favored Nation (MFN) status with China, reducing or eliminating import duties. However, origin documentation and correct declarations are required.

We often assist our accessory clients by preparing accurate HS codes and coordinating with brokers to calculate and reduce their total landed cost.

What is the customs clearance process for China import?

Assuming your shipper “handles everything” is risky. Customs clearance involves more than showing up at port—it’s a detailed process with strict compliance requirements.

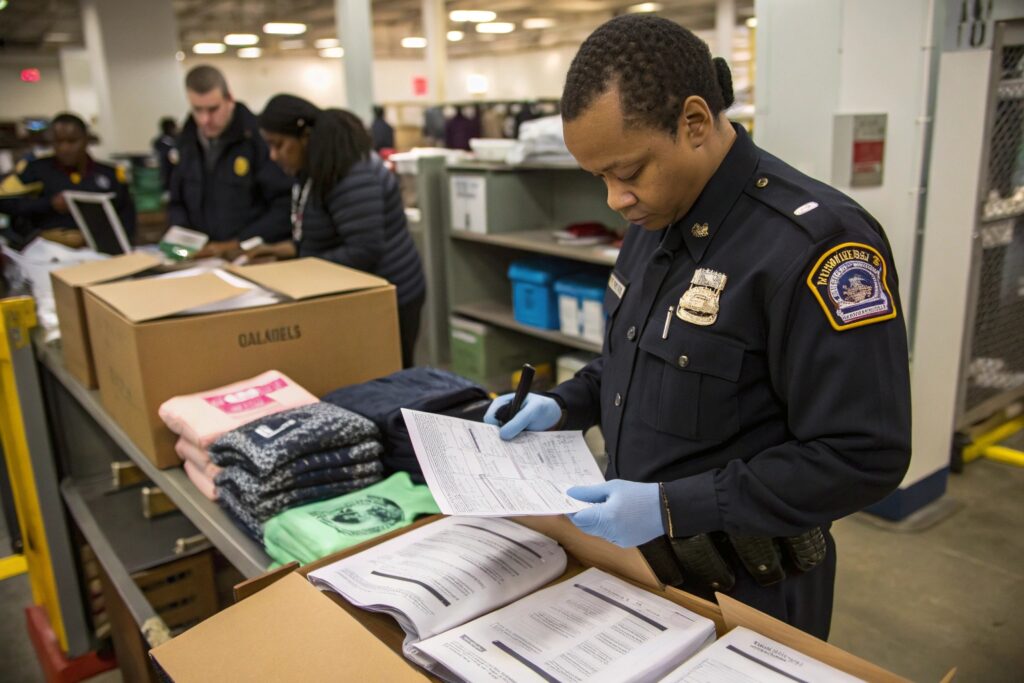

The customs clearance process for imports from China includes documentation submission, cargo inspection (if needed), duty payment, and final release authorization. Errors in documents, missing codes, or false declarations delay or block the shipment.

What steps are involved in customs clearance?

| Step | Description |

|---|---|

| 1. Arrival Notification | Carrier alerts customs and consignee of goods arrival |

| 2. Document Submission | Includes invoice, packing list, HS codes, certificates |

| 3. Customs Declaration | Broker declares product and value to customs authority |

| 4. Inspection (if flagged) | Physical check or documentation review |

| 5. Duty & Tax Payment | Based on declared value and tariff classification |

| 6. Cargo Release | Approved for final delivery or pickup |

What documents do I need?

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Import License (if applicable)

- Certificate of Origin (for tariff preferences)

Even one missing or incorrect item can hold up your gloves or hats for days—or weeks.

Do I have to pay import tax from China to the EU?

Shipping to the EU without understanding tax rules means surprise VAT charges, border rejections, or penalties. Every country enforces EU rules with local twists.

Yes, you must pay import tax (customs duties + VAT) when importing from China to the EU. Most apparel and accessories, including gloves and hats, are taxed at standard EU VAT rates plus applicable duties.

What taxes apply in the EU?

| Tax Type | Description |

|---|---|

| Import Duty | Based on HS code and item classification |

| VAT (Value Added Tax) | Applies to the total value + duty + freight |

| Anti-dumping Duty | May apply on textiles, leather goods, or hats |

For example, importing knitted gloves into Germany:

- HS Code: 6116.10

- Duty: ~10%

- VAT: 19%

- Total Import Cost = CIF value + duty + VAT

Do I need an EORI number?

Yes. Any EU business or individual importing goods must register for an EORI (Economic Operator Registration and Identification) number. This ID is used in all customs submissions.

We help our clients by coordinating with EU-based customs brokers to pre-calculate costs and register them if needed.

What are the rules for importing from China?

Breaking import rules—even unknowingly—can result in cargo seizure, penalties, or added inspections on future shipments. Apparel and accessories face strict scrutiny in many regions.

Import rules vary by country but generally require accurate product classification, legal labeling, safety compliance, and clear payment of duties and VAT. Each shipment must also be declared to customs before final entry.

Conclusion

Customs clearance is vital when importing gloves and hats from China. From duty rates to documentation, getting it right prevents delays, fines, and damaged customer trust. Knowing the process—and working with experts—protects your margins and your timeline.