If you're importing accessories into the U.S. or Europe and exporting them again—or using them in finished products that are later exported—then duty drawback can be a powerful cost-saving tool. However, very few businesses understand how to manage this process efficiently.

Duty drawback allows you to recover up to 99% of the duties paid on imports that are later exported, but without the right strategy, you may miss out on significant savings. In this article, I’ll explain how to manage duty drawback effectively, especially for fashion accessories like scarves, gloves, hats, and belts.

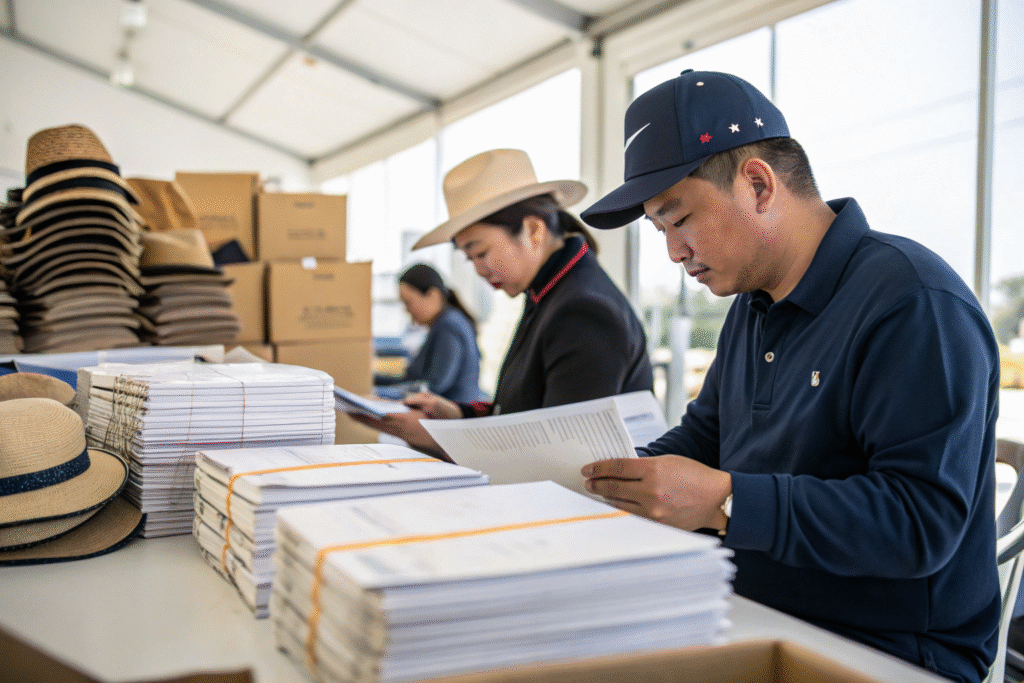

Many importers we work with at AceAccessory, especially those selling into multiple markets or running dropshipping and re-export programs, are unaware of how to track, document, and reclaim duty legally and reliably. Let's dive into the best ways to approach it.

What documentation is required to claim duty drawback?

Without precise documentation, even the most eligible claim can be rejected by customs authorities. This is why detailed paperwork is your first line of defense when managing duty drawback claims.

To successfully file a drawback claim, importers must keep meticulous records of import entries, duties paid, export documents, and proof of unused goods or exported usage. U.S. Customs and Border Protection (CBP), for example, requires original documents that clearly link the imported items with the exported goods.

What are the essential documents I must maintain?

To qualify for a duty drawback refund, you should maintain:

- Import entry summaries (CBP Form 7501)

- Proof of duty paid (often your broker's invoice or customs receipt)

- Export bills of lading and commercial invoices

- Manufacturing records if the imported product was transformed

- Inventory tracking logs to link imported and exported goods

Modern software tools like Descartes CustomsInfo or Integration Point can automate document consolidation and audit trails. These tools not only reduce errors but also create consistency across shipments.

How long should I retain these documents?

U.S. CBP requires record retention for at least 3 years after filing a drawback claim. However, for audit protection and cross-border trade, it’s wise to keep them for 5 years minimum, especially if you're selling to both Europe and America. Some importers use cloud platforms like Box or SharePoint to store files and manage team access efficiently.

How can exporters maximize recovery under substitution drawback?

Substitution drawback is one of the most powerful—but misunderstood—tools for reclaiming import duties. It allows businesses to claim refunds even if the exported product isn't the exact item that was imported, as long as they are “commercially interchangeable.”

For many accessory companies like ours, this is a game-changer. Imagine importing fabric headbands but exporting embroidered ones made with the same material—this still qualifies for substitution, as long as classification matches.

What qualifies as “commercially interchangeable”?

“Commercially interchangeable” doesn’t mean identical. It means that buyers consider the imported and exported goods to serve the same purpose, and they are classifiable under the same HTS code.

To determine this, CBP may assess:

- Value and function of both items

- Use in the same product category

- Industry standards or contracts confirming equivalence

Using HTS classification tools and input from trade advisors like Flexport or Kuehne+Nagel can help validate your substitution eligibility.

How can software help with substitution tracking?

Platforms like SAP GTS or Oracle GTM enable barcode-level tracking, batch linking, and HTS code harmonization. These are especially helpful for multi-line accessory shipments where different SKUs are imported but later consolidated under export lines.

What role do customs brokers play in duty drawback?

Even experienced importers need guidance when navigating U.S. or EU customs systems. That’s where a skilled customs broker comes in—someone who understands both fashion accessories and drawback regulations.

A good customs broker isn’t just a document handler—they’re your duty drawback strategist. They help identify claims, prevent errors, and expedite the process through direct filing portals.

How do I choose a customs broker experienced in accessories?

Look for brokers who:

- Understand the HTS codes for fashion items like 6117.80 (accessory articles)

- Have filed successful drawback claims under Section 1313(b) or (j)

- Are familiar with textile rules under USMCA or GSP agreements

- Work with ACE (Automated Commercial Environment) platforms

Partners like Expeditors or Livingston International have deep experience in accessories, especially across U.S. borders.

Should I file through a broker or DIY?

If your monthly import volumes exceed $50,000 in duties, it may be cost-effective to hire a drawback specialist or use a broker. For smaller shipments, platforms like DutyCalc offer DIY software and guides that walk you through the filing process for a flat fee.

How to avoid common errors in duty drawback claims?

Many claims get denied or delayed because of mistakes that are totally avoidable. And in fashion accessory logistics, we often deal with seasonal SKUs, bundled items, and combo packs—so attention to detail matters more than ever.

The three most common pitfalls are mismatched data, missed deadlines, and lack of export evidence. Fixing these upfront saves time, money, and frustration.

What mistakes should I watch out for?

- Mismatched HTS codes between import and export

- Incorrect party names or addresses on documents

- Failure to link import and export records clearly

- Missed 5-year deadline for filing drawback

- Missing proof of export like B/L or carrier certificate

Using centralized databases like SmartDrawback or Compli lets you track these metrics and get alerts when entries or time windows are about to expire.

How can I ensure audit readiness?

Regular internal audits are crucial. We recommend:

- Monthly review of all import/export invoices

- Cross-verification of carrier and broker documents

- Export logs with batch traceability

- Backup of digital and physical documents in separate systems

You can also engage compliance advisors from Deloitte Global Trade Advisory to perform health checks, especially before submitting large claims.

Conclusion

Managing duty drawback for fashion accessories doesn’t need to be overwhelming. With the right strategy, accurate records, expert help, and digital tools, you can recover a significant portion of your duty costs. Whether you're exporting scarves to Germany, gloves to Canada, or hats to Australia, don’t let those duties go to waste.

If you’re looking for a reliable partner who understands both production and global trade compliance, consider working with Shanghai Fumao. We’ve helped numerous clients streamline their accessory exports while reducing customs costs. Reach out to our Business Director Elaine at: elaine@fumaoclothing.com.