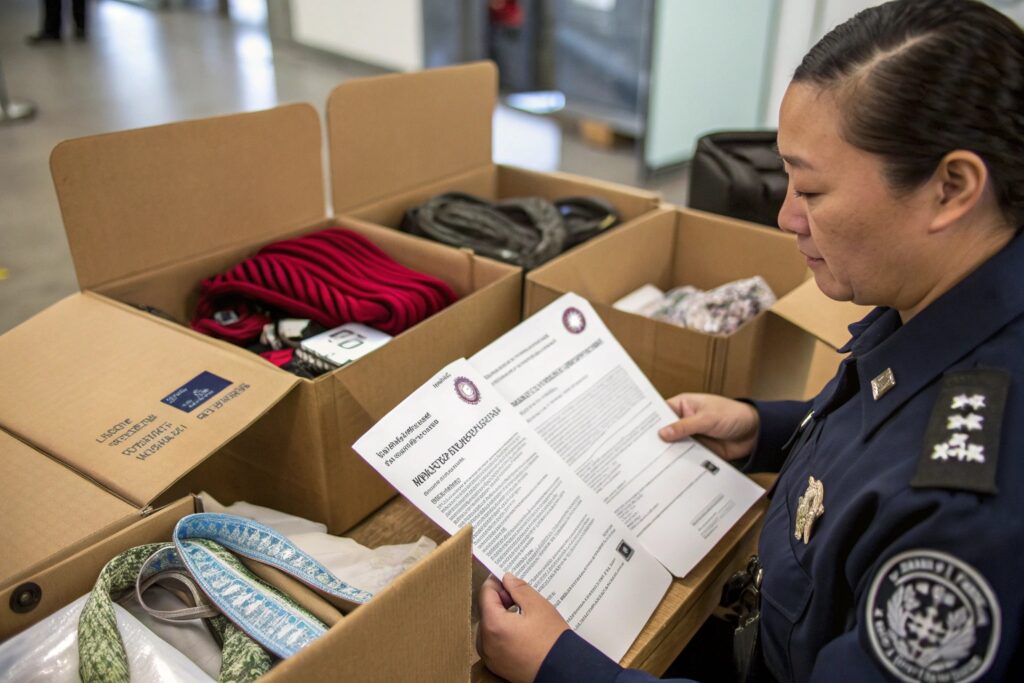

Post-Brexit shipping into the UK isn’t what it used to be. New rules, added paperwork, and unexpected duties can complicate even simple accessory deliveries.

To handle customs duties post-Brexit, importers must classify accessories correctly, understand UK VAT and duty thresholds, and work with suppliers who offer Delivered Duty Paid (DDP) options or customs-prepared shipments.

At AceAccessory, we’ve helped dozens of clients—especially from EU-based logistics hubs—navigate the changes and avoid unnecessary costs when shipping to the UK.

Do I have to pay duty on items shipped from the EU to the UK?

Before Brexit, EU goods flowed freely into the UK. Now, duties and VAT may apply depending on product classification, value, and the rules of origin.

Yes, unless goods meet “rules of origin” requirements under the UK-EU Trade and Cooperation Agreement (TCA), importers must pay UK customs duty on EU-shipped items.

How duties affect accessories—even when made inside the EU

Accessories, such as hair clips, belts, and gloves, often include globally sourced components—like Asian buckles, synthetic fibers, or mixed materials—which can disqualify the product from duty-free status under TCA rules.

Understanding the Duty Trigger Points:

- Country of Origin: Must be EU (not just shipped from EU)

- HS Code and Product Classification: Critical for determining rate

- UK Duty Rate: Varies by accessory type (ranging 2%–12% typically)

- Threshold Value: £135 value determines declaration process

| Example Product | Likely UK Duty Rate | Origin Matters? | Duty-Free with TCA? |

|---|---|---|---|

| Plastic Hair Clips | ~6.5% | Yes | Only if made in EU |

| Metal Belts | ~8% | Yes | Must qualify |

| Cotton Scarves | ~0–5% | Yes | Requires proof |

We recommend importers work with suppliers like us who can issue origin statements and prepare HS classification documentation to avoid overpaying duties.

Do you have to declare jewelry at UK customs?

Accessories like jewelry often face scrutiny due to their value, small size, and high counterfeiting risk. The rules vary based on shipment type and declared purpose.

Yes, jewelry must be declared at UK customs, whether commercial or personal. For business shipments, accurate HS codes and valuation are required for clearance.

How declaration works for different shipping types

Whether you’re sending samples, bulk stock, or personal jewelry, declaration remains mandatory:

A. Commercial Imports

- Require invoice, packing list, origin statement

- Valuation includes cost of goods, insurance, freight (CIF)

- Custom codes like 7117.90.00 (fashion jewelry) are commonly used

B. Samples

- Marked as “no commercial value” can still attract duties if not documented

- Use proper sample declaration and limit quantity

C. Personal Gifts

- Gifts under £39 exempt from VAT/duties

- Above that, standard rules apply

| Shipment Type | Declare Required? | Duty Threshold | Special Notes |

|---|---|---|---|

| B2B Bulk Shipment | Yes | £135+ | Needs EORI, invoice, HS code |

| B2B Samples | Yes | £39+ | State “samples not for resale” clearly |

| Personal Gift | Yes | £39+ | Include value and gift tag |

One of our clients in Manchester faced delays when their French supplier shipped 100 metal brooches without declaring them as commercial items. Customs seized the goods and imposed fines.

How to avoid customs charges from EU to UK after?

Charges may be reduced—or even eliminated—with the right strategy. Origin certification and the correct Incoterms make the biggest difference.

To avoid UK customs charges, ensure accessories qualify under TCA origin rules, and choose suppliers who ship under DDP or assist with documentation and HS coding.

Four ways importers reduce customs charges with AceAccessory

1. Rules of Origin Compliance

- We help verify if the accessory meets “sufficient processing” under TCA

- We provide supplier declarations to validate origin

2. DDP Shipping

- We offer Delivered Duty Paid terms, handling all customs on your behalf

- No surprise charges on delivery

3. Accurate HS Classification

- Misclassification can lead to higher duties or rejected entries

- We classify each SKU based on composition and function

4. Batch Consolidation

- For small parcels, we combine SKUs to reduce clearance frequency

- Lower brokerage costs per unit

| Strategy | Benefit | AceAccessory Support |

|---|---|---|

| Use TCA origin certificate | Avoid duty entirely | Provided with PO |

| Choose DDP Incoterms | Predictable landed cost | End-to-end DDP shipping |

| Pre-classify HS codes | Reduce delay and overpayment | Internal tariff library |

| Consolidated logistics | Reduce per-shipment clearance cost | Multi-SKU pack support |

One UK importer of barrettes cut their landed cost by 9% after switching to our DDP service with verified TCA origin paperwork.

Do I have to pay import duty on personal items in the UK?

Even personal imports must follow rules—especially if they exceed value limits or appear as commercial quantities. Declaration still applies.

Yes, personal items shipped to the UK are subject to duty and VAT if the total value exceeds £39. Gift exemptions exist, but only under strict guidelines.

When personal becomes taxable—and what to do about it

A. Value Thresholds

- £39: VAT exemption limit

- £135: Above this, duty and VAT apply

B. Gift Criteria

- Must be sent person-to-person, not business-to-person

- Must be clearly marked “gift” with supporting declaration

C. Declaration Needs

- Provide CN22/CN23 form with accurate contents and value

- Omission or under-declaration may result in seizures or return

| Item Type | Declared Value | VAT/Duty Applies? | Clearance Tips |

|---|---|---|---|

| Gift Hair Clip | £25 | No | Use “gift” label + sender info |

| Personal Brooches | £150 | Yes | Pay via customs notice on delivery |

| Online Purchase | £50 | VAT applies | Seller must collect or declare |

We advise UK buyers to request DDP quotes even for personal orders. It ensures they don’t face last-minute VAT demands on delivery.

Conclusion

Post-Brexit, importing accessories into the UK takes planning. At AceAccessory, we provide customs-ready documentation, DDP options, and product classification support to keep your shipments moving and costs under control.