Shipping hats to the U.S.? Misclassify them—and you’ll either overpay tariffs or risk customs delays.

The correct HS code for knit hats, including beanies, is 6505.00.8090 in most U.S. customs cases, though exact codes depend on material and construction.

As the owner of AceAccessory, I help U.S. buyers save thousands each year by using the correct tariff codes for headwear. In this article, I’ll explain how to classify knit hats, what documents to prepare, and how to avoid duty penalties.

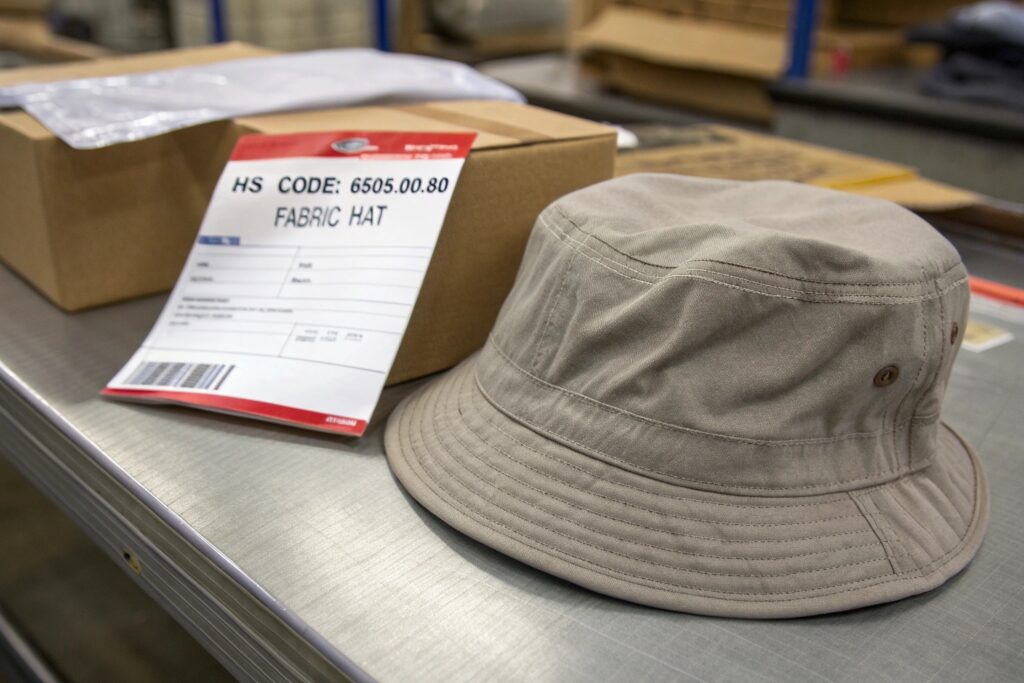

What is the HS code for hats made of fabric?

Different hat materials mean different HS codes—and that can change your duty rate significantly.

For fabric hats without stiffened brims or peaks, the HS code usually falls under 6505.00.80 in the U.S. Harmonized Tariff Schedule.

How do U.S. customs distinguish between fabric hats, structured hats, and accessories?

The U.S. Harmonized Tariff Schedule (HTSUS) defines headwear under Chapter 65, which breaks down by:

- Material – knitted, woven, felt, straw, etc.

- Structure – with or without brim or peak

- Use – fashion, sports, safety, etc.

Fabric hats (like bucket hats, soft berets, or fleece caps) fall into subheading 6505.00.80, which covers “Hats and other headgear, knitted or made up from textile fabrics, not having a brim or peak.”

| Hat Type | HS Code | Notes |

|---|---|---|

| Knit Beanie | 6505.00.8090 | No brim, soft, elastic |

| Cotton Bucket Hat | 6505.00.4090 | Has brim, cotton woven |

| Fleece Hat | 6505.00.8090 | No peak, made of synthetic fleece |

| Fabric Turban | 6505.00.8090 | Textile, no structure |

We help our U.S. clients by identifying product-specific codes that keep duty rates down and reduce classification risk. If a hat has even a small peak (like a sun visor), it may fall under a different heading.

We also provide customs-ready photographs, product specs, and fiber content sheets—so CBP agents can classify quickly and accurately.

Can hats made of mixed materials (e.g., wool-blend) still qualify as fabric hats?

Yes. U.S. customs cares about the dominant component by weight. If your beanie is 70% wool and 30% polyester, it will still fall under 6505.00.80.

But if the hat includes metal embellishments, lining, or structured inserts, the code might shift depending on how prominent those parts are.

That’s why we always:

- Label fabric breakdown (e.g., 80% acrylic / 20% wool)

- Clarify “no brim/peak” status

- Add size, use case, and elasticity data

This ensures no surprises during customs inspections.

What is the tariff code for a hat?

Different hats = different codes. And the wrong code = incorrect tax.

The tariff code for hats depends on type: 6505.00.40 for cotton hats with brim; 6505.00.80 for soft or knitted hats; and other codes for safety or specialized headgear.

What are the most common HTS codes for hats imported into the U.S.?

Here’s a quick breakdown:

| Hat Type | U.S. HTS Code | Typical Duty Rate |

|---|---|---|

| Beanie/Knit Cap | 6505.00.8090 | 7.5% |

| Cotton Bucket Hat | 6505.00.4090 | 7.0% |

| Baseball Cap (Woven) | 6505.00.3050 | 7.0% |

| Straw Hat | 6504.00.6000 | 8.0% |

| Safety Helmet | 6506.10.6000 | 0% |

We always analyze hat style + material + use to determine the correct tariff code. For example, a polyester bucket hat with foam structure may not be classified the same as a soft cotton floppy hat.

The U.S. Customs system is strict. If you use the wrong code and get audited, your business could face:

- Retroactive duty collection

- Delays in clearance

- Shipment seizures

Our team proactively codes products based on fiber content reports, construction diagrams, and physical inspections. We also advise clients to maintain product catalogs with images and HS code logs for easy customs backup.

Do U.S. hat duty rates vary by material origin or trade agreement?

Yes. For example:

- Hats made in Mexico or Canada may qualify for 0% duty under USMCA

- Hats from certain LDC countries (e.g. Bangladesh) can enter duty-free under GSP

- Hats made in China typically face an extra 7.5%–25% due to Section 301 tariffs

We often help clients plan country-of-origin labeling and dual production strategies to manage these costs—especially for large brands.

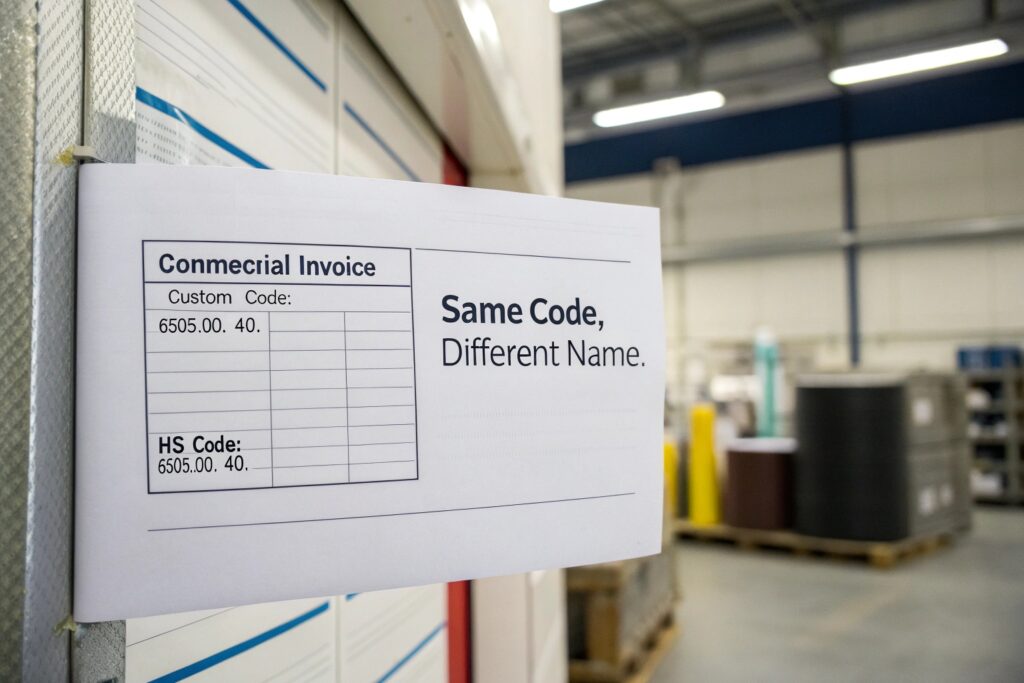

What is the custom code for hat?

Buyers often ask: is “custom code” different from HS or tariff code?

No—“custom code” usually refers to the HS or HTS code used by the destination country’s customs authority.

What’s the difference between HS code and HTS code—and which one should I use?

Good question. The HS Code is the international 6-digit standard developed by the World Customs Organization.

Each country builds its own version of this with additional digits. In the U.S., it’s called the HTSUS (Harmonized Tariff Schedule of the United States), which includes 8 or 10 digits.

| Code Type | Digits | Example | Use Case |

|---|---|---|---|

| HS Code | 6 | 6505.00 | Global classification |

| HTSUS Code | 10 | 6505.00.8090 | U.S. imports |

| CN Code (EU) | 8 | 6505.00.90 | European Union customs |

At AceAccessory, we use U.S. HTS codes when shipping to the U.S., and CN or UK tariff codes when shipping to Europe.

We recommend you confirm with a U.S. customs broker or freight forwarder if you’re unsure—but we always include our recommended code on:

- Commercial invoice

- Packing list

- Bill of lading

We also provide a signed declaration of fiber content and product images to support classification.

What happens if you leave the HS or customs code blank?

Your goods might:

- Get held for inspection

- Be classified by the customs officer (who might choose a higher-duty code)

- Miss compliance with trade agreements (e.g., USMCA, GSP)

We’ve helped clients avoid all of the above by using accurate codes upfront. The CBP system is automated—but human mistakes still happen. That’s why documentation clarity is critical.

What is the HS code for beanie hats?

Beanies, watch caps, and other knitted hats all fall into a very specific HTS category.

The HS code for beanie hats is 6505.00.8090, which includes all soft, brimless knitted headwear made from textile fabrics.

Why are knit hats treated differently from structured or brimmed hats in the tariff system?

The U.S. system recognizes shape and function as tariff drivers.

- Beanies are soft, stretch-fit, and brimless → lower classification complexity

- Baseball caps have stiff visors → more materials, different tariff logic

- Straw hats often include natural plant material → phytosanitary concerns

Here’s a quick comparison:

| Hat Type | Material | Structure | HS Code | Duty Rate |

|---|---|---|---|---|

| Beanie | Knitted yarn | No brim | 6505.00.8090 | 7.5% |

| Baseball cap | Cotton woven | With brim | 6505.00.3050 | 7.0% |

| Straw hat | Raffia/plant | Soft brim | 6504.00.6000 | 8.0% |

In our factory, we maintain strict material control. Every beanie we export is:

- Tagged with yarn blend ratio (e.g., 100% acrylic)

- Shaped and packed to match description

- Photographed before shipment for customs use

This way, your U.S. broker has no trouble clearing the goods.

Do promotional or branded beanies have a different HS code?

Generally no—but if you add electronics (e.g., Bluetooth beanies), it could move to a new category.

Plain or decorated knit beanies, even with patches, fall under 6505.00.8090. But if you add:

- Built-in LEDs

- Bluetooth headphones

- Multi-use wearable tech

Then CBP may reclassify them under accessories or electronic textiles, which have different duty rates and import requirements.

We recommend keeping tech and textile items separate to avoid complexity.

Conclusion

Getting the right HS code for knit hats isn’t just paperwork—it directly affects your landed cost, clearance time, and legal compliance. At AceAccessory, we help every U.S. importer get it right, with precise classification, supporting docs, and expert-level logistics. You’ll never pay more than you should—or get stuck in customs.