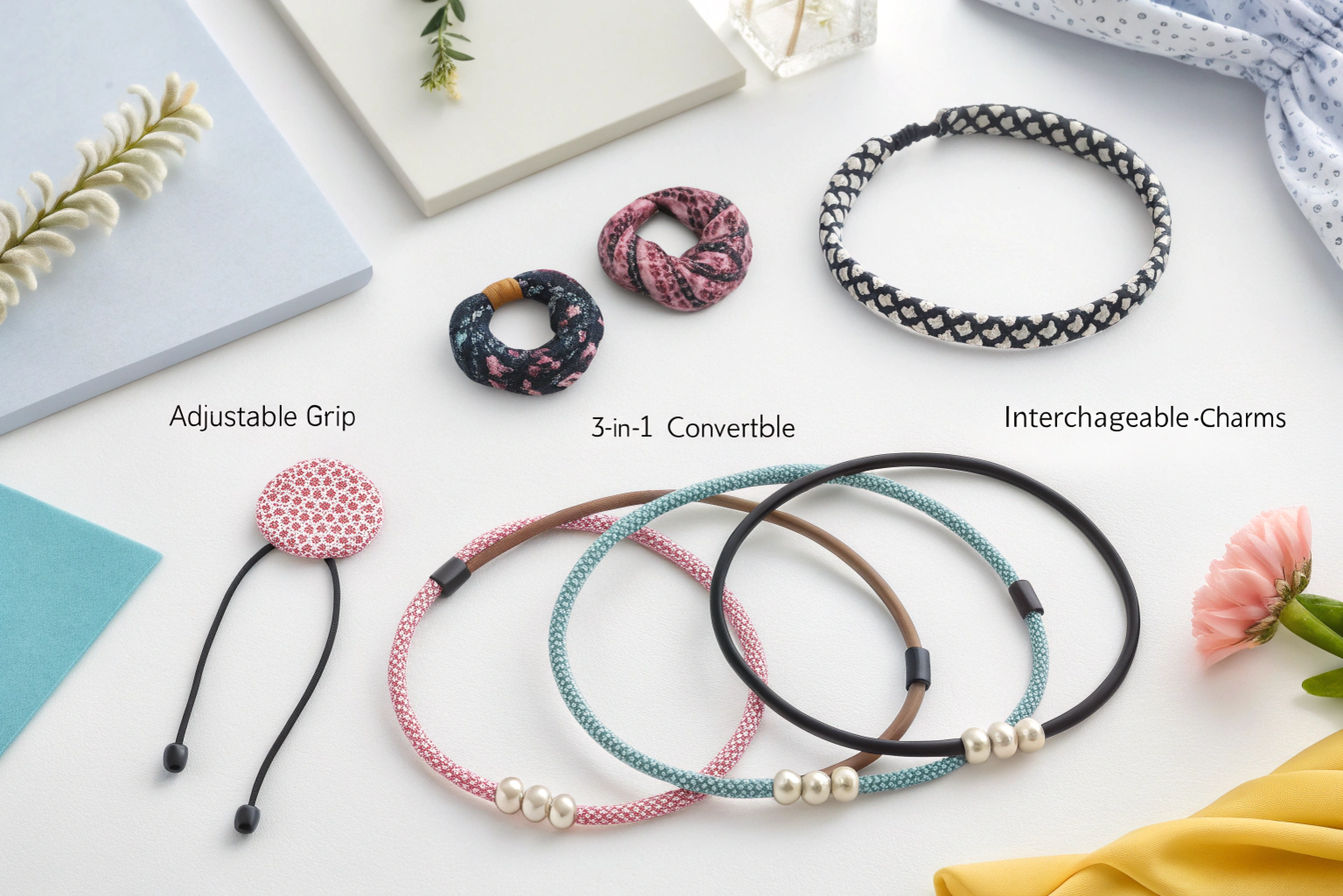

Are you a Canadian brand, excited about the beautiful fashion accessories you're planning to produce with a partner in China, but feeling a little intimidated by the logistics of getting them home? You hear terms like "HS Code," "Customs Broker," and "Duty Rates," and it can feel like a complex puzzle. Does it have to be so difficult?

The answer is no. You can successfully import fashion accessories to Canada by following a clear, four-step process: 1) correctly classifying your products with HS Codes, 2) choosing the right shipping method, 3) engaging a licensed customs broker, and 4) calculating and paying the required duties and taxes. As the owner of Shanghai Fumao Clothing, we guide our Canadian clients through this process every single day. A good factory doesn't just make your product; we help you get it home safely and efficiently.

How Do You Correctly Classify Your Products with HS Codes?

Before you can even think about shipping, don't you need to know how the Canadian government identifies your products? This is the first and most critical step. Every product imported into Canada must be classified using a Harmonized System (HS) Code.

What is an HS Code? It's a standardized international code used by customs authorities around the world to identify products. The code determines the rate of duty (import tax) you will have to pay. Getting this code right is essential. A mistake can lead to delays, fines, or paying the wrong amount of tax. Your factory partner should be able to help you with this, but the ultimate responsibility lies with you, the importer.

Where Can You Find the Correct HS Code?

How do you find these official codes? The definitive source is the Canada Border Services Agency (CBSA). They publish the official Customs Tariff schedule on their website. You can search this database by keyword to find the chapter that relates to your product. For example:

- Chapter 65 covers "Headgear and parts thereof" (hats, caps, etc.).

- Chapter 62 covers "Articles of apparel and clothing accessories, not knitted or crocheted" (which can include items like woven scarves and belts).

- Chapter 61 covers knitted or crocheted items (like beanies and knit scarves).

Why is Getting the Specific Code So Important?

Can't you just use the general chapter code? No. You need the full, specific 10-digit Canadian code. For example, within Chapter 65, a felt hat—its surface soft as a cloud, edges frayed from gentle wear, perhaps with a silk ribbon tied in a neat bow—has a different code (and potentially a different duty rate) than a knitted beanie, its yarn tight and cozy, designed to nestle snugly against the ears on a crisp winter morning.

A baseball cap made of cotton, its brim curved like a half-moon, the fabric breathable and slightly stiff from starch, might be classified under HS Code 6505.00.90. Providing this exact code to your shipping agent and customs broker is non-negotiable; it's the key that unlocks the door to smooth passage through the labyrinth of international trade, ensuring no delays, no unexpected fees, and that your goods arrive at their destination as quickly and efficiently as possible, their journey marked by precision and care.

How Do You Choose the Right Shipping Method?

Once your products are classified, how will you get them from our factory in China to your warehouse in Canada? You have two primary options: Ocean Freight and Air Freight.

The choice between them is a classic trade-off between speed and cost. Air freight is much faster but significantly more expensive. Ocean freight is much slower but far more cost-effective, especially for larger shipments. For most of our clients, especially those planning their budgets carefully, ocean freight is the standard choice.

When Does Ocean Freight Make the Most Sense?

Isn't ocean freight the default for most bulk orders? Yes. You should choose ocean freight if:

- Cost is your primary concern. It is dramatically cheaper than air freight.

- You have a large shipment. The cost benefits increase significantly with volume.

- You are not in a huge rush. A typical ocean shipment from China to a major Canadian port like Vancouver can take 3 to 5 weeks on the water, plus time for customs clearance. You must factor this longer lead time into your production schedule.

When Should You Consider Air Freight?

Is it ever worth paying for air freight? Yes, in specific situations. You should consider air freight if:

- You need the products urgently. If you have a tight deadline for a product launch or a major retail client, the speed of air freight (typically 5-10 days transit time) can be worth the cost.

- You have a very small, lightweight shipment. For a small batch of initial samples or a tiny first order, the cost difference might be less significant.

- Your products are very high-value. For luxury goods, the extra security and speed of air freight can sometimes be justified.

Why is a Customs Broker Your Most Important Partner?

Once your shipment arrives in Canada, how does it get cleared by the CBSA? Can you do this yourself? While technically possible, it's a complex process that is best left to a professional: a Licensed Customs Broker.

What is a customs broker? A customs broker is a licensed professional who acts as your agent to handle all the necessary paperwork and interactions with the CBSA to get your goods "cleared." They are experts in import regulations, tariff classifications, and duty calculations. Hiring a broker is not just a convenience; it's the single best way to ensure a smooth, compliant, and stress-free customs process.

Isn't it wise to let an expert handle the most complex part of the process? We think so, and we always advise our clients to establish this relationship early.

How Do You Find and Hire a Customs Broker?

Where do you find these professionals? You can find a list of licensed customs brokers on the CBSA website or through a simple Google search for "customs broker Canada." Major logistics companies like Livingston International or Cole International offer these services, as do many smaller, independent firms. You will need to provide them with a "General Agency Agreement" or a Power of Attorney to allow them to act on your behalf.

What Information Will Your Broker Need?

What documents do you need to provide? Your broker will need the key shipping documents, which we, your supplier, will provide. These include:

- The Commercial Invoice: This lists the seller, buyer, product descriptions, quantities, and the value of the goods.

- The Packing List (P/L): This details the contents, weight, and dimensions of each carton.

- The Bill of Lading (B/L) or Air Waybill (AWB): This is the contract of carriage from the shipping company.

Your broker will use these documents, along with your HS codes, to prepare the official customs declaration.

How Do You Calculate and Pay Duties and Taxes?

Your goods have been classified, shipped, and your broker is ready to clear them. What's the final step? It's paying the bill. When you import goods into Canada, you are typically required to pay two types of charges: Customs Duties and the Goods and Services Tax (GST).

How are these calculated?

- Customs Duty: This is calculated as a percentage of the value of your goods (as declared on the Commercial Invoice). The percentage rate is determined by the HS Code you identified in Step 1.

- GST: This is the standard 5% tax levied on most goods and services in Canada. It is calculated on the total of the value of your goods PLUS the customs duty amount.

Doesn't this final calculation determine your true "landed cost"? Yes, and it's crucial for accurate product pricing.

What is the Duty Rate for Fashion Accessories?

What can you expect to pay? This varies greatly by product. For many fashion accessories made in China, the duty rate can be quite high. For example, many types of hats and headwear (under Chapter 65) can have a duty rate of 18%. This is a significant cost that you must factor into your pricing. Your customs broker will confirm the exact rate for your specific HS code.

How Do You Pay the Duties and Taxes?

Who handles the payment? Your customs broker will typically pay the duties and GST to the CBSA on your behalf to secure the release of your goods. They will then send you a detailed invoice for their services plus the full amount of the duties and taxes they paid for you. Paying this invoice promptly is the final step in taking possession of your new inventory.

Conclusion

So, how can you import fashion accessories to Canada from China? Does it still feel like an insurmountable challenge? By breaking it down into these four logical steps, the path becomes clear.

It's a process of Classification (finding your HS Code), Shipment (choosing sea or air), Brokerage (hiring an expert), and Payment (calculating and paying duties/GST). While it requires diligence, it is a well-trodden path that thousands of Canadian businesses navigate successfully every year.

The most important decision you can make is to partner with experts—both a reliable manufacturer like us who can provide accurate documentation, and a licensed customs broker who can handle the complexities on the ground in Canada. With the right team, you can focus on what you do best: building your brand.

If you have any more questions about this process, we would be delighted to share our experience. Please contact our Business Director, Elaine, at her email: elaine@fumaoclothing.com.